The adult content creation industry, primarily facilitated by platforms like OnlyFans and Fanvue, is a rapidly expanding sector within the broader “creator economy”. This industry allows individuals and couples to monetize explicit content, attracting a diverse range of creators and generating substantial revenues, though it also faces considerable controversy and regulatory scrutiny.

Key Platforms and Their Operations

• OnlyFans:

Launched in the UK in 2016, OnlyFans is widely recognized for enabling content creators to publish photos and videos, predominantly erotic and pornographic, on paid subscription accounts. The platform’s business model relies on subscribers paying for access to content and private messaging (PPV), with OnlyFans retaining a 20% commission on these transactions and tips. While OnlyFans advertises various content, such as fitness and cooking, a significant portion (98%) of its content is adult-oriented due to its permissive stance on explicit material. Fenix International Limited, OnlyFans’ parent company, was acquired in 2018 by Leonid Radvinsky, who also owns other adult entertainment sites.

• MYM: This French platform, established in 2018, operates on a similar model to OnlyFans, allowing creators to sell photos and videos via monthly subscriptions. MYM takes a commission of 20% or 25% on transactions, with the remainder distributed to creators. MYM attempts to project an image as a “clean” and “universal” platform for diverse content, but adult content remains a substantial part of its business. MYM has demonstrated exponential growth in certified creators, increasing from 8,499 in 2021 to 167,000 in 2024.

• Fanvue:

Launched in 2020 and based in the UK, Fanvue positions itself as a creator-friendly alternative to OnlyFans, allowing adult content while aiming to offer improved tools for monetization and community building. It provides subscription-based access, PPV messaging, and tipping, and retains a 20% commission—mirroring industry standards. Fanvue promotes its use of AI moderation tools and a creator-first approach, emphasizing transparency and better revenue opportunities. While it welcomes creators from all verticals, adult content remains a dominant category. The platform has gained attention for its fast onboarding and low payment thresholds, appealing to newcomers in the adult creator space.

• Fansly:

Founded in the United States in 2020, Fansly rose to prominence following OnlyFans’ brief announcement in 2021 to ban sexually explicit content (a decision later reversed). Fansly capitalized on this uncertainty by offering a similar platform with a strong commitment to adult content creators. Its features include tiered subscriptions, PPV content, messaging, and a “follower-only” feed. Fansly takes a 20% commission on earnings and distinguishes itself with user-friendly discoverability tools and enhanced privacy options. It has become a go-to alternative for creators seeking a more stable or supportive platform for adult work.

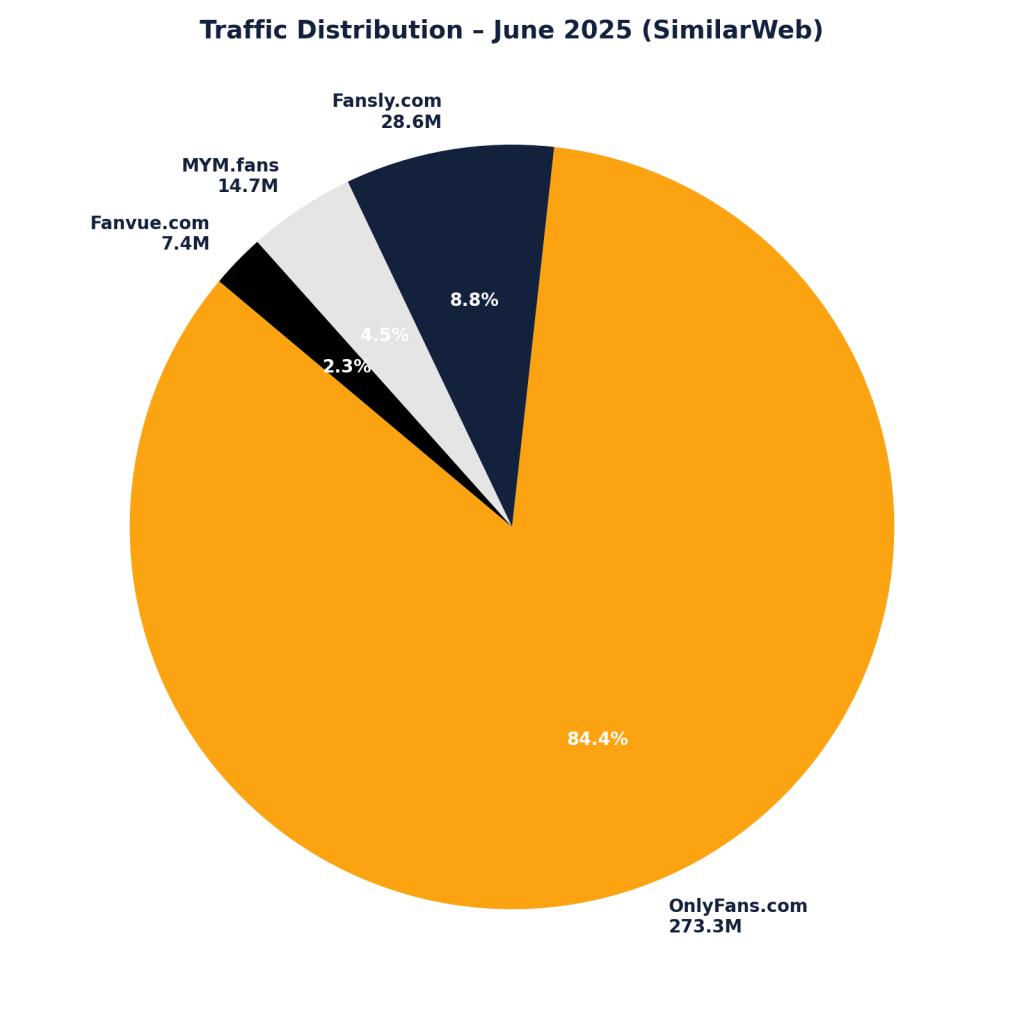

Industry Scale and Financial Performance

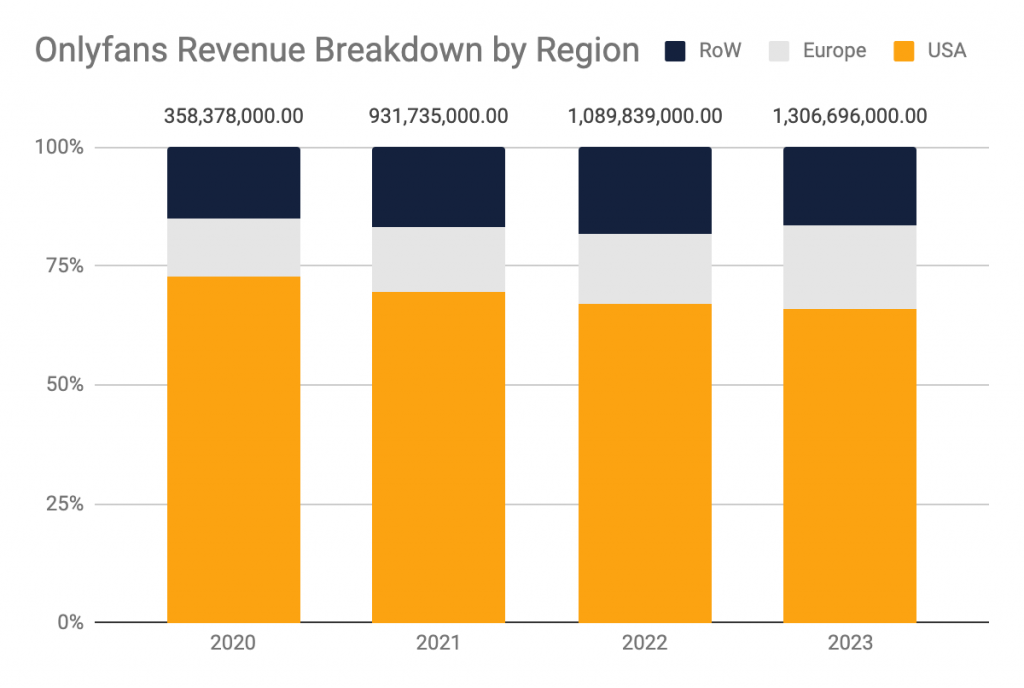

OnlyFans: By September 2021, OnlyFans reported over 150 million users and more than 1.5 million content creators. By the end of its fiscal year in November 2023, the platform had grown to 4.1 million creator accounts (a 29% increase from 2022) and a total of 305 million fan accounts (up 28% year-on-year). In 2023, OnlyFans generated $6.6 billion in revenue for Fenix International, marking a billion-dollar increase from 2022. Its pre-tax profit reached $658 million in 2023, up from $525 million in 2022. Leonid Radvinsky, the majority shareholder, has received over $1 billion in dividends since 2020. The platform’s owner is currently in talks to sell OnlyFans for around $8 billion.

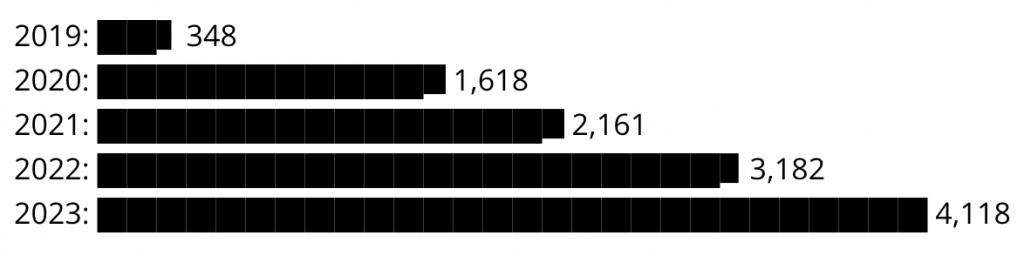

Onlyfans creators over time (in millions)

Onlyfans shows remarkable 11x creator growth over 5 years, with the most significant percentage jumps occurring in 2020 (+365% – thank you COVID-19 and lockdowns…) . The consistent upward trajectory indicates strong market adoption, though the 2023 growth rate decline may warrant monitoring until publication of 2024 annual results.

Creator Demographics and Motivations

Creators on these platforms are notably diverse, often consisting of ordinary individuals, including students, engineers, television showgirls, mothers, and even public servants. Their motivations are varied:

• Financial Gain: Many are drawn by the allure of “easy money” and the prospect of supplementing or replacing their income. Some prominent creators, like Alexis Mucci, claim to earn significant amounts, ranging from €30,000 to €120,000 per month on OnlyFans. Polska claimed €10,000 in a month, later €30,000 in days. Nathalie, a former French reality TV candidate, reportedly earned €100,000 in several weeks on OnlyFans and an additional €50,000 on MYM. In the U.S., Blac Chyna (now Angela White) was reported to be the top OnlyFans earner, making up to $20 million per month at her peak. However, the average income for most creators is considerably lower, approximately $134 per month.

• Self-Acceptance and Confidence: Some young women report that selling explicit content helps them “accept their body” and boosts their self-confidence.

• Personal Exploration and Lifestyle: Couples engage with these platforms to “spice up their relationship” and “discover themselves more,” viewing the activity as an exciting “game”.

• Industry Adaptation: Influencers experiencing a decline in traditional brand partnerships (some seeing incomes divided by ten) are increasingly using OnlyFans as lucrative alternatives to maintain their lifestyles, with some reporting earnings over €100,000 per month.

Risks and Negative Consequences for Creators

Despite the perceived advantages, creators face substantial risks:

• Content Theft and “Revenge Porn”: Creators are highly susceptible to their content being stolen and re-shared on other platforms (so-called leak platforms), often without their consent or for third-party profit. This is known as “revenge porn”. While platforms like OnlyFans have implemented technical measures to prevent content downloading, they acknowledge that screenshots remain unavoidable. Some have introduced a tracking system for files, enabling the identification of the recipient of leaked media and imposing a €500 fine per instance. Polska, a creator whose content was leaked, now pays €500 monthly to have her photos removed from the internet, some DMCA takedown SaaS companies have emerged to automate the process.

• Harassment and Abuse: Many creators regularly receive threats, insults, and sexually explicit messages from subscribers. Some messages contain disturbing content, including threats of sexual violence.

• Psychological Impact: Justine Atlan, Director General of the French e-Enfance association, warns that monetizing one’s image can compromise a person’s physical and psychological integrity, potentially leading to feelings of objectification. Vulnerable individuals with pre-existing low self-esteem may experience depression, self-harm, or substance abuse due to negative online interactions.

• Presence of Minors: Despite age verification efforts, minors have been identified as both creators and users on OnlyFans and MYM. A 2020 BBC documentary estimated that 40% of OnlyFans creators were minors. Although OnlyFans claims to have enhanced its age verification (requiring ID photos and selfies), minors can circumvent these measures by using an adult’s identity. Similarly, MYM’s AI-based age verification is not foolproof, with a reported margin of error of 1.3 years for ages 13-17, and forged identification documents have been successfully used in tests.

• Links to Pimping and Prostitution: These platforms are increasingly viewed as potential “recruitment grounds” and facilitators for prostitution, particularly involving minors. The transition from virtual interactions to real-life encounters is a major concern, with organized networks utilizing OnlyFans to attract new clientele and arrange in-person sexual services. This phenomenon is described as a “dematerialization of pimping” and an “uberization of sexuality,” where sexual acts become commodified.

Regulatory Landscape and Challenges

The industry faces growing demands for stricter regulation due to its controversial nature:

• Age Verification: OnlyFans was fined £1 million by Ofcom for providing inaccurate information regarding its age verification processes. The platform erroneously stated its facial estimation technology’s “challenge age” was 23, when it was actually 20, and later adjusted to 21, highlighting a lack of “robust fact-checking processes”. MYM also employs AI for age verification, but its susceptibility to manipulation remains a concern, and they have also been reported to outsource some verification to teams in Sri Lanka.

• Content Moderation: OnlyFans asserts that it moderates all content—text, messages, audio, and live streams—through a combination of human and AI verification, and collaborates with law enforcement for illegal content. MYM similarly uses AI (HIVE) to filter prohibited content and employs human moderators for ambiguous cases. However, critics argue these measures are insufficient to prevent widespread abuses.

• International Legal Framework: Under many juridictions law, hosting sites typically have limited liability, with content creators being primarily responsible for the media they disseminate. French lawmakers are currently developing new legislation to define “on-demand pornography” and potentially classify it as a form of prostitution, aiming to outlaw “OFM” agencies if they facilitate such activities. Sweden has recently enacted legislation that prohibits the purchase of online sexual acts, including private media, effectively equating it to physical prostitution and potentially leading to a ban on OnlyFans services within the country. In contrast, in Germany, where prostitution is legal, a direct ban on OnlyFans is not currently under political discussion, though concerns regarding youth protection persist.

The Role of Agencies (OnlyFans Management – OFM)

A notable feature of the adult content creation industry is the proliferation of “OnlyFans Management” (OFM) agencies.

• Function: These agencies, frequently operated by young male individuals below 30 (some as young as 16 or 17), proactively recruit content creators on social media. They promise significant earnings (e.g., €30,000 per month) and offer to manage creators’ accounts on platforms like OnlyFans. Their services encompass content creation, social media presence management, and direct client interaction through “chatters”.

• Business Model: Agencies levy a considerable commission on creators’ earnings, often ranging from 50% to 80% of their total revenue. Some agents employ “mass DM” techniques to entice young women, making grand promises of high earnings and support to create an impression of ease and security. “Chatters,” often based in the Philippines for english speaking audience or francophones from Madagascar, are hired to respond to client messages, earning 5-10% commission on sales.

• Ethical Concerns and Exploitation: Many of these agencies are criticized for their lack of ethical standards, being described as “catastrophes”. They are accused of treating creators as mere “cattle,” prioritizing profit over ethical considerations. There are reports of agents pressuring creators to produce more explicit content. Incidents of blackmail have also been documented, where agents seize control of creators’ accounts and divert their earnings. Models, often uninformed about their rights, can become victims of harassment and coercion. Training for aspiring agents can include misogynistic elements, instructing them to exploit creators’ emotions to maximize content production. Some agencies even resell models’ contracts and social media codes without the models receiving any compensation from these transactions.

• Legal Standing: Legally, these agencies are considered permissible as long as their activities are limited to “connecting models on MYM and OnlyFans with clients” and all exchanges remain virtual. However, French parliamentarians are actively working to reclassify these agencies as engaging in “pimping” to render their operations illegal. MYM or Reveal asserts its “agnostic” stance regarding agencies, denying that it takes commissions from them, but it does offer incentives for agencies to register with its services, such as faster creator integration and simplified identity verification. Notably, major payment processors like Visa and MasterCard refuse to work with OnlyFans and MYM, forcing these platforms to use smaller, specialized digital payment companies that charge higher fees (20-30% of revenue). Cryptocurrencies are also used for high-value transactions, particularly by young agents.

Impact on Clients

Subscribers to these platforms, predominantly male and sometimes in relationships, spend substantial amounts of money—hundreds to thousands of euros—on subscriptions and private content (they are name whales by the agencies). Their motivations include a preference for “amateur content” over “industrial porn” and the convenience of “facilitating encounters” with creators, thereby blurring the lines between virtual interaction and actual prostitution.

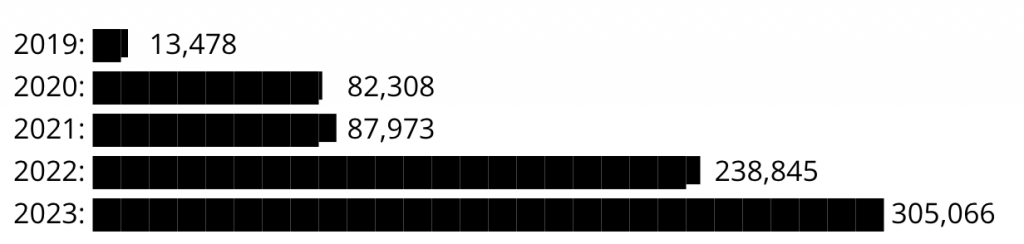

Onlyfans fans over time (in millions)

The fan data shows even more dramatic growth than the creator metric, with a 2164% increase over 5 years. The 2022 growth (+150.9M fans) was particularly remarkable, accounting for nearly half of all fan growth in this period. While 2023 shows some growth moderation, the absolute gain remains substantial. The fan base is scaling at nearly double the rate of the creator base.

In summary, the adult content creation industry, largely driven by platforms like OnlyFans, presents substantial opportunities for creators and agencies, as evidenced by its rapid growth and significant financial performance. While it offers individuals diverse motivations, from financial independence to personal exploration, it also navigates complex challenges, including the imperative for robust content moderation and age verification, given concerns around content leakage, harassment, and the presence of minors. The emergence of management agencies further shapes this landscape, offering support but also raising significant ethical and legal questions regarding exploitation and contractual transparency. As the industry continues to expand and adapt, understanding these multifaceted elements is key to ensuring that creators can make truly informed choices and thrive.